Finance & Budgets

UIDAI Finance & Accounts Division

The Finance & Accounts Division (FD) is headed by the Deputy Director General (Finance) who is Financial Advisor in UIDAI. FD renders professional advice to the CEO, UIDAI on all issues which have financial implications.

The FD is responsible for Budget formulation, Outcome Budget, Performance Budget, Screening of proposals involving financial implications, Expenditure and Cash Management and Preparation of Annual Accounts of UIDAI.

Role of Finance & Accounts Division

Financial Advice/Concurrence

- Associating with policy and program formulation activities to facilitate proper appreciation of the financial implications.

- Advice on delegation of financial powers;

- Financial advice on all matters involving expenditure/concurrence to financial proposals for Acceptance of Necessity (AON) and Expenditure Angle Sanction (EAS) of Competent Authority.

- Vetting of tender/RFP documents, contracts including amendment of contract from financial angle.

- Scrutiny of and concurrence to foreign deputation proposals of officers of UIDAI

- Representation in various committees (CAB, Tender opening and Financial Evaluation Committee, Commercial Negotiation Committees, Other Committees) and

- Internal control systems by way of Procurement Manual to ensure ‘Due Diligence’ and compliance of rules and regulations and guidelines of the Ministry of Finance in respect of various procurements and contracts.

Budget preparation

- Preparation of Budget and related work (Budget Estimate, Revised Estimate and Supplementary Grants, re-appropriation, etc.) and

- Allocation of budget among Functional Divisions at HQ and Regional Offices

Drawing & Disbursement

- Payment of salary and allowances to employees of HQ.

- Payment of salary and allowances to employees of RO.

- Payment and settlement of personal claims of employees and

- Payment of all types of bills for goods and services received from suppliers.

Book keeping

- Maintenance of all books of accounts and preparation of monthly, quarterly and annual financial statements and

- Maintenance of Fixed Asset Register and depreciation accounting.

Expenditure and Cash Management

- Monitoring and control of expenditure and accounting functions of HQ and ROs.

- Maintenance of PBG register and safe custody of PBG.

- Bank reconciliation and

- Investment of surplus funds and safe custody of instruments thereof.

Internal Audit

- Preparation of Annual Audit Plan for quarterly audit of HQ, annual performance audit of Functional Divisions of HQ and annual audit of ROs/Tech Centre).

- Deployment of manpower for audit, finalization and issue of Audit Report to concerned Division/RO/Tech Centre and

- Follow up of compliance of internal audit observations.

Other Activities

- Matters relating to CAG/PAC/Audit Paras in respect of UIDAI;

- Vetting of reply/compliance of Functional Divisions on Audit paras issued by O/o the Director General of Audit, P&T, New Delhi.

- Providing inputs for Annual Report, Economic Survey, Monthly PMO Report and

- Work in respect of Parliamentary Standing Committee of Finance for UIDAI related matters.

Budget and Expenditure

Budget and Expenditure of UIDAI since its inception in 2009:

|

Year |

Budget Estimates (in Crore) INR |

Revised Estimates (in Crore)INR |

Expenditure (in Crore) INR |

|---|---|---|---|

|

2009-10 |

120.00 |

26.38 |

26.21 |

|

2010-11 |

1,900.00 |

273.80 |

268.41 |

|

2011-12 |

1,470.00 |

1,200.00 |

1,187.50 |

|

2012-13 |

1,758.00 |

1,350.00 |

1,338.72 |

|

2013-14 |

2,620.00 |

1,550.00 |

1,544.44 |

|

2014-15 |

2,039.64 |

1,617.73 |

1,615.34 |

|

2015-16 |

2,000.00 |

1880.93 |

1680.44 |

|

2016-17 |

1140.00 |

1135.27 |

1132.84 |

|

2017-18 |

900.00 |

1150.00 |

1149.38 |

|

2018-19 |

1375.00 |

1345.00 |

1181.86 |

|

2019-20 |

1227.00 |

836.78 |

856.13$ |

|

2020-21 |

985.00 |

613.00 |

893.27* |

|

2021-22 |

600.00 |

1564.97 |

1564.53 |

|

2022-23 |

1110.00 |

1220.00** |

1634.44# |

|

2023-24 |

940.00 |

800 |

1396.22# |

|

2024-25 |

600.00 |

600.00 |

1286.03# |

|

2025-26 |

600.00 |

605.00 |

547.42@ |

- $Excess expenditure met from unspent grant of 2018-19

- *Excess expenditure met from unspent grant of 2018-19 & 2019-20 and UIDAI Fund

- **Including Rs.110 crore received as supplementary grant

- #Excess expenditure met from UIDAI Receipt.

- @ Expenditure upto September 2025

Reference

To efficiently discharge our responsibility, we are guided by the following publications:

- General Financial Rules, 2017

- UIDAI Procurement Manual

- Other instructions issued by the Ministry of Finance, Ministry of Electronics & Information Technology (MeitY), CVC, etc.

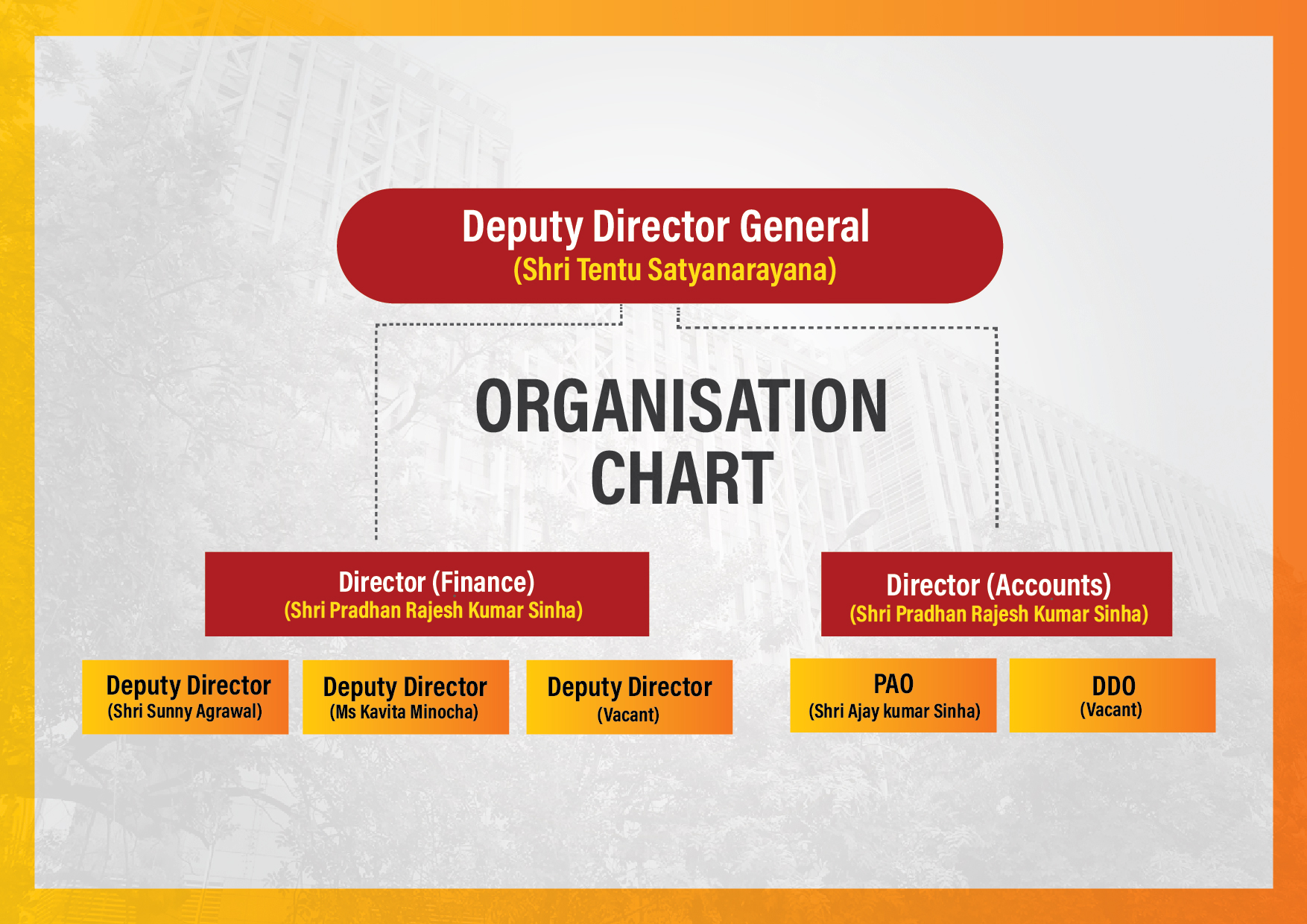

Organization Chart

Deputy Director General (Finance) is assisted by the following team for efficient discharge of assigned functions.

Summarized Financial position as on 30th September 2025

| (Rs. In Crore) | |||||

|---|---|---|---|---|---|

|

Grants Head |

BE 2025-26 |

Funds Released by MeitY |

Consolidated Expenditure upto August, 2025 |

Expenditure during September, 2025 |

Consolidated Expenditure upto September, 2025 |

|

31- Grants in Aid: General |

410.00 |

215.00 |

385.72 |

72.6 |

458.32* |

|

35- Grants for creation of capital assets |

123.00 |

55.00 |

28.7 |

22.95 |

51.65* |

|

36- Grants-in-aid salaries |

67.00 |

30.00 |

28.83 |

8.72 |

37.55* |

|

Total |

600.00 |

300.00 |

443.25 |

104.27 |

547.52 |